Turn Up The Heat - Or Did They Already?

June update from Jason

Summer is here! After the heat wave this weekend, the rain and cooler temps were a nice refresher. Check out what the market is doing this warm season.

The data and information below come from a research firm I subscribe to called the Sherman Sheet. Their information is timely and accurate and I think you will find it a very detailed and informative update on the markets.

The big picture:

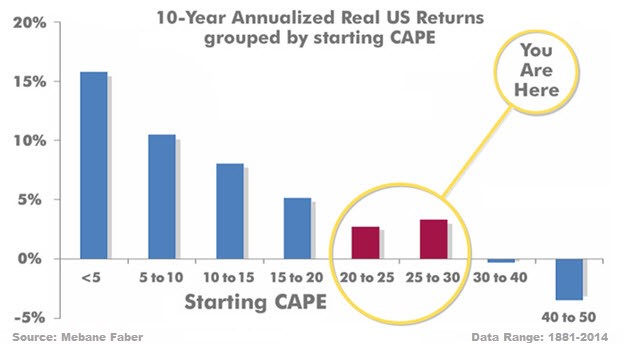

The question of whether we are in a continuing Secular Bear Market that began in 2000 or in a new Secular Bull Market has been the subject of hot debate among economists and market watchers since 2013, when the Dow and S&P 500 exceeded their 2000 and 2007 highs. The Bear proponents point out that the long-term PE ratio (called “CAPE”, for Cyclically-Adjusted Price to Earnings ratio), which has done a historically great job of marking tops and bottoms of Secular Bulls and Secular Bears, did not get down to the single-digit range that has marked the end of Bear Markets for a hundred years, but the Bull proponents say that significantly higher new highs are de-facto evidence of a Secular Bull, regardless of the CAPE. Even if we are in a new Secular Bull Market, market history says future returns are likely to be modest at best. The CAPE is at 26.19, little changed from the prior week’s 26.22, after having earlier reached the level also reached at the pre-crash high in October, 2007. Since 1881, the average annual return for all ten year periods that began with a CAPE around this level have been just 3%/yr.

This could suggest that above-average returns will be much more likely to come from the active management of portfolios than from passive buy-and-hold.

In the market:

The big news last week came from the Federal Reserve Chair Janet Yellen. Contrary to prior thought, Yellen commented that an interest rate hike was not imminent. After her statement, stocks promptly rallied to a 7-month high. The Dow Jones Industrial Average was the lone positive U.S. index for the week, up +0.33% to 17,865. All of the other indexes I follow were slightly negative for the week including: the LargeCap S&P 500 ending down ‑0.15%, the S&P 400 MidCap index giving up -0.12%, and the SmallCap Russell 2000 down just -0.02%. The tech-heavy NASDAQ Composite fared the worst among U.S. indices, ending the week down -0.97%. Money flows headed for defensive destinations, with Bonds and the Utilities sector both up for the week.

However, commodities fared well after being down 4 of the last 5 weeks. Silver gained over +5.4% to $17.33 an ounce, and gold gained $29.80 to $1,276.30 an ounce, up +2.39%. Interestingly, industrial metal copper gave up the last 2 weeks of gains by losing over -4.4%. Oil started the week strongly but reversed and ended slightly down to close at $48.88 a barrel for West Texas Intermediate, down -0.04%. It is important to note that my diversification strategy incorporates multiple sectors of the market into your portfolio to optimize your investments.

In U.S. economic news, the Labor Department’s “Job Openings and Labor Turnover Survey” showed that job openings matched the record high set in April, but hiring activity sank to the lowest since August. Job openings rose +118,000 to 5.788 million while actual hires fell -198,000 to 5.092 million. Oftentimes, politicians quote these statements—but what do they really mean? Perhaps employers are not hiring, maybe an under qualified labor force, or could we be doing a better job of correctly matching skills of employees with employers seeking those skills?

Contrary to the shocking Non-Farms Payroll (NFP) report issued on June 3rd, showing a puny 38,000 job gain in May, a broader and (some say) more timely view of the state of the job market is not so gloomy. Federal income and employment tax withholdings is telling a more upbeat story. Investor’s Business Daily reports that the latest data from June 3rd shows that over the previous month withheld taxes rose +4.7% from a year earlier, which is the fastest growth rate in seven months.

To end on a fun summer note:

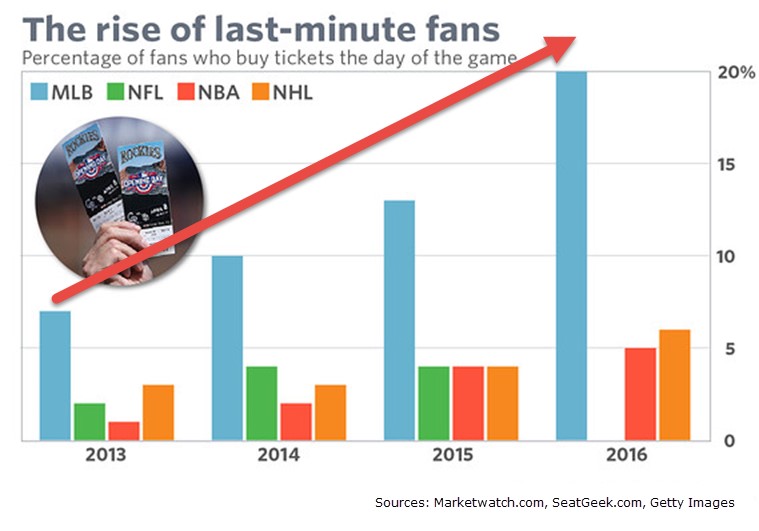

An interesting new phenomenon in sports—more and more baseball fans are purchasing their tickets on game day rather than purchasing and planning their attendance well in advance. So far this year, 20% of baseball fans purchased their tickets on game day, quadruple the number from 2012—and it’s growing fast. As buying and selling of tickets on secondary markets becomes more convenient, ticket sales on game day have surged. Baseball seems to be particularly well-suited for the practice due to the frequency of games and generally more hospitable weather. Happy summer everyone! Take me out to the ballgame…