A Late Summer Market Discussion

Greetings everyone. I hope these last few days of August find you well. It is still very much summer in the Midwest with typical heat and humidity in the Sioux Falls area heading into Labor Day weekend.

Here is a truncated look at the markets from last week, thanks to our friends at the Sherman Sheet in St Louis. I will close with some thoughts on the week ahead.

In the markets:

Stocks ended mostly lower for the week after worries of an upcoming Federal Reserve rate hike erased earlier gains. The Dow Jones Industrial Average fell -157 points to 18,395, down -0.85%. The tech heavy NASDAQ composite fared slightly better, down -0.37% to 5,218. The LargeCap S&P 500 index fared the worst of the major indexes, falling -0.68%, while the S&P MidCap 400 index fell -0.2% and the SmallCap Russell 2000 managed to eke out a small gain of +0.1%. Utilities continued their recent bad stretch, down -2.36% for the week and down more than -5% for August, driven by the twin forces of a risk-on shift and rekindled fears of rising interest rates.

Precious metals continued to lose their shine with Gold down $20.30 to $1,325.90 an ounce, a loss of -1.5%. Silver, likewise, was down over -2.9% to $18.75 an ounce. The industrial metal copper, sometimes used as a leading indicator of overall global economic activity, fell over -3.8%. Oil had its first weekly loss in the last 4, declining -2.99% to $47.64 per barrel of West Texas Intermediate crude.

In housing, new-home sales surged to the highest level in nearly 8 years on strong demand from buyers and an increase in building activity. On Tuesday, the Commerce Department reported that new home sales rose +12.4%, to a seasonally adjusted annual rate of 654,000 units last month. The rate was +31.3% higher than this time last year, and easily beat economists’ forecasts of 581,000. The median sales price of a new home last month stood at $294,600. At the current sales pace, there is a 4.3 month supply of homes on the market. As a caveat, the government’s new-home sales data can be quite volatile and comes with a large margin of error. However, Trulia Chief Economist Ralph McLaughlin released a note stating that last month’s figures “are a rare case where the year-over-year change is statistically significant, indicating the surge in sales can be taken with more than just a grain of salt.”

Of interest, I have taken a position in the exchange traded fund (ETF) that tracks the timber and forestry industries, ticker symbol WOOD, as of August 10th. With new home sales going up we hope to capitalize in an increased demand for building products.

On Friday, Federal Reserve Chairwoman Janet Yellen said that the case for another interest rate hike “is strengthening”, sending a signal that the US central bank could raise rates as soon as next month. “In light of the continued solid performance of the labor market and our outlook for economic activity and inflation, I believe the case for an increase in the federal funds rate has strengthened in recent months,” Yellen remarked in a speech in Jackson Hole, Wyoming. Yellen reaffirmed that the Fed policy committee “continues to anticipate” that gradual increases in the fed-funds rate will be appropriate.

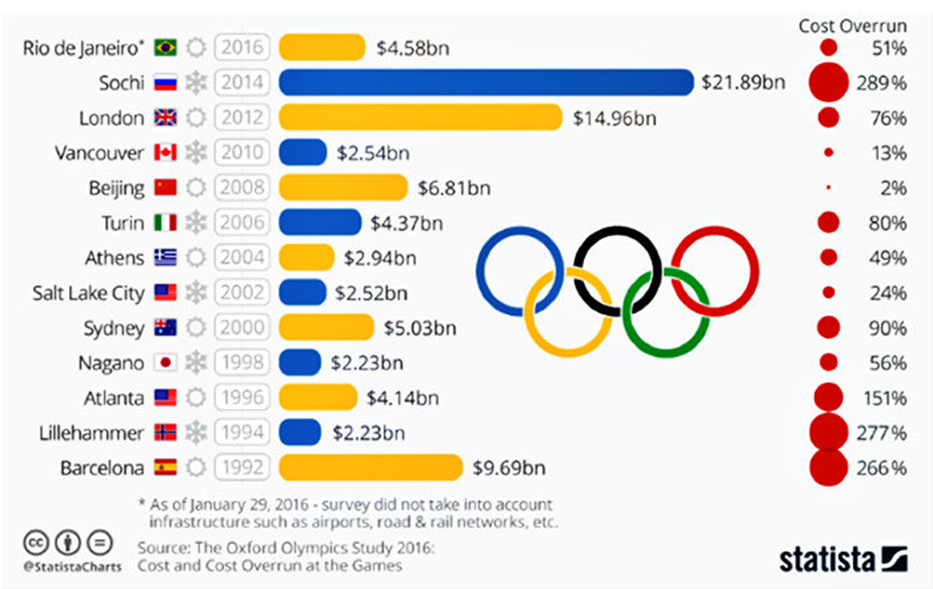

Finally, last Sunday’s closing ceremony signaled the end of the 2016 Summer Olympics. Now that the party is over, the hangover has set in as organizers calculated the final cost of hosting the event. Online statistics portal Statista reported “The organizers have put in a huge amount of work and invested an impressive amount of cash to get to this point…Costs ran 51% over budget in Rio, ending up at $4.58 billion. Even though that may seem like a huge amount of money, it pales in comparison to the Winter Olympics in Sochi in 2014. Costs there quickly snowballed with many venues coming in catastrophically over budget…hosting the Olympics is expensive with the people of Hamburg (Germany) voting to withdraw their city’s bid for the 2024 games in late 2015, primarily on funding grounds.”

The following graphic shows the costs of hosting each of the Olympics since 1992, and their staggering overruns. Note that not a single one came in at or under budget.

(sources: all index return data from Yahoo Finance; Reuters, Barron’s, Wall St Journal, Bloomberg.com, ft.com, guggenheimpartners.com, ritholtz.com, markit.com, financialpost.com, Eurostat, Statistics Canada, Yahoo! Finance, stocksandnews.com, marketwatch.com, wantchinatimes.com, BBC, 361capital.com, pensionpartners.com, cnbc.com, FactSet)

The Week(s) Ahead

It has been a long, impatient summer. One of my key sources of research has been making the case for a short-term correction in US markets since mid-July. Reacting to that research, I have been steadily lessening our exposure to stocks for over seven weeks now.

There are currently multiple factors that point to a “take shelter” event:

- Increasing volatility in the VIX

- Major resistance to upside movement in the Nasdaq 100

- Increased Put activity suggesting traders are starting to hedge

- Eroding investor sentiment

- Seasonality (September holds three of the five weakest weeks of the 3rd Quarter)

If this potential 4% to 7% pullback starts to take shape, the interesting longer term outlook for the remainder of 2016 suggests an additional 10% to 13% upside. So, election aside, I am still quite positive about how we will finish out 2016.

Stay tuned!

Material discussed is meant for general illustration and/or informational purposes only and it is not to be construed as investment, tax or legal advice. Although the information has been gathered from sources believed to be reliable, please note that individual situations can vary. Therefore, the information should be relied upon when coordinated with individual professional advice.