An Early August Outlook

Hello Everyone,

A few thoughts on the markets as we roll into August. Some of the data included in this blog is courtesy of the Sherman Sheet.

In the markets:

The week got off to a slow start with trading volumes on Monday among the lowest of the year. Not surprising as we’ve been talking about the seasonality of the market and how things tend to slow down in the summer months. Activity picked up later in the week as Thursday was the busiest day for second quarter earnings releases with over 70 S&P 500 companies reporting results.

For the week, the Dow Jones Industrial Average rose 262 points to close at 22,092, a gain of 1.2%. The tech-heavy Nasdaq Composite, however, fell -0.36% to close at 6,351. By market cap, large caps outperformed the small cap indexes. The large cap S&P 500 index managed a 0.19% gain, while the S&P 400 mid cap index and the Russell 2000 small cap index both suffered their second week of losses, falling -0.62% and -1.19% respectively.

The number of employed Americans hit a new high of 153.5 million, lifting the employment-to-population ratio up to 60.2%. Analysts universally praised the report. David Berson, chief economist at Nationwide stated, “This is an unambiguously positive jobs report, as it suggests that consumers will have the wherewithal to increase spending (with solid job gains and faster wage growth) and that inflation may be slowly pushed higher by tighter labor and product markets.”

Professional firms, health-care providers, and restaurants accounted for the bulk of the new jobs. In the details, however, one ugly fact was revealed: job creation was largely from part-time jobs, which gained 393,000 positions. Full-time positions actually fell by 54,000 according to the Commerce Department. Analysts watch consumer spending closely because it accounts for 70% of economic activity in the United States. Andrew Hunter, economist with Capital Economics said that the new report showed that consumer spending has lost some momentum at the end of the second quarter “which isn’t a particularly promising sign going into the third quarter.” In the details, the reduction in income growth was attributed to declines in dividend and interest payments, and other investment income. The category for wages and salaries actually rose a respectable 0.4% in June, reflecting the solid employment growth during the month.

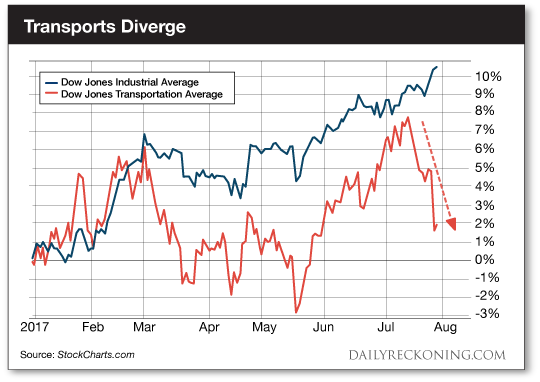

Finally: An old Wall Street saying goes something like “When the soldiers leave the field of battle, the generals are soon to follow.” The meaning is that when the few stock market leaders are all alone, and most other stocks have already turned down…the few leaders are likely to follow as well. Mid Cap and Small Cap stocks have broken down recently, and now the important Transports sector has diverged sharply from the Dow Jones Industrials. A venerable market theorem, “The Dow Theory”, raises red flags when the Dow Industrials and the Transports diverge significantly. They recently have, as illustrated by the chart below.

There are an unlimited number of cases to be made for a market top or for continued upward success. Only time and proactive planning will help us navigate to the best of our ability. Hope you all have a great week.

(sources: all index return data from Yahoo Finance; Reuters, Barron’s, Wall St Journal, Bloomberg.com, ft.com, guggenheimpartners.com, zerohedge.com, ritholtz.com, markit.com, financialpost.com, Eurostat, Statistics Canada, Yahoo! Finance, stocksandnews.com, marketwatch.com, wantchinatimes.com, BBC, 361capital.com, pensionpartners.com, cnbc.com, FactSet; Figs 1-5 source W E Sherman & Co, LLC)